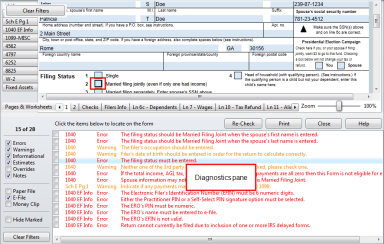

Checking Returns for Errors

The Check Return feature checks a return for common errors and missing data. The process of checking a return for errors is also called diagnostics.

Even if you're paper filing, running Check Return helps you avoid IRS rejections and/or issues with your client's return.

The Check Return feature

- Recalculates the return before scanning it for errors, critical omissions, and warnings.

- Adds missing or associated forms that should be included in the return.

If a form was previously attached to the return and discarded, it will not be included.

- Lists of errors that must be corrected in order to file the return.

- Lists informational diagnostics you may want to review but don't require action on your part.

- Reports any fields whose amounts were overridden or marked as estimated.

- Lists errors specific to e-filing as well as basic errors relating to either form of filing.

- Lists errors specific to paper filing as well as basic errors relating to either form of filing.

Although the Check Return feature identifies missing and/or inconsistent information, it cannot verify the accuracy of the information provided in the return.

To check your return for problems:

- From the open return, do one of the following:

- Click the Check Return button on the toolbar.

- Click the Tools menu; then, select Check Return.

- Press Ctrl+E.

The Diagnostics pane appears. It displays errors and warnings.

- In the Diagnostics pane, click an error or warning.

The selection is highlighted in blue. In the form area, the system jumps to the corresponding field in the form:

- Correct the error, as necessary.

- After you have corrected the errors, create the e-file. See Creating E-files.

- Click the Re-Check button on the Diagnostics pane to clear the error.

The Diagnostics pane also appears when you create an e-file, and the button name changes from Re-Check to Re-Create E-file(s). See Creating E-files.

- Repeat the steps above until you've cleared the Diagnostics pane of errors.

You cannot electronically file returns that contain errors or estimates. However, you can electronically file returns that contain informational or warning messages.

To hide specific errors temporarily, select the boxes next to the errors and click the Hide Marked check box. Click the Clear Filters button to display any errors that were previously hidden.

Printing Check Return Diagnostics

To print a report of your Check Return results, click the Print button above the Diagnostics pane.

See Also: